BFI Mission & Vision

Our vision is the full financial inclusion of developing and emerging countries and equal opportunities to access global trade, finance and payments.

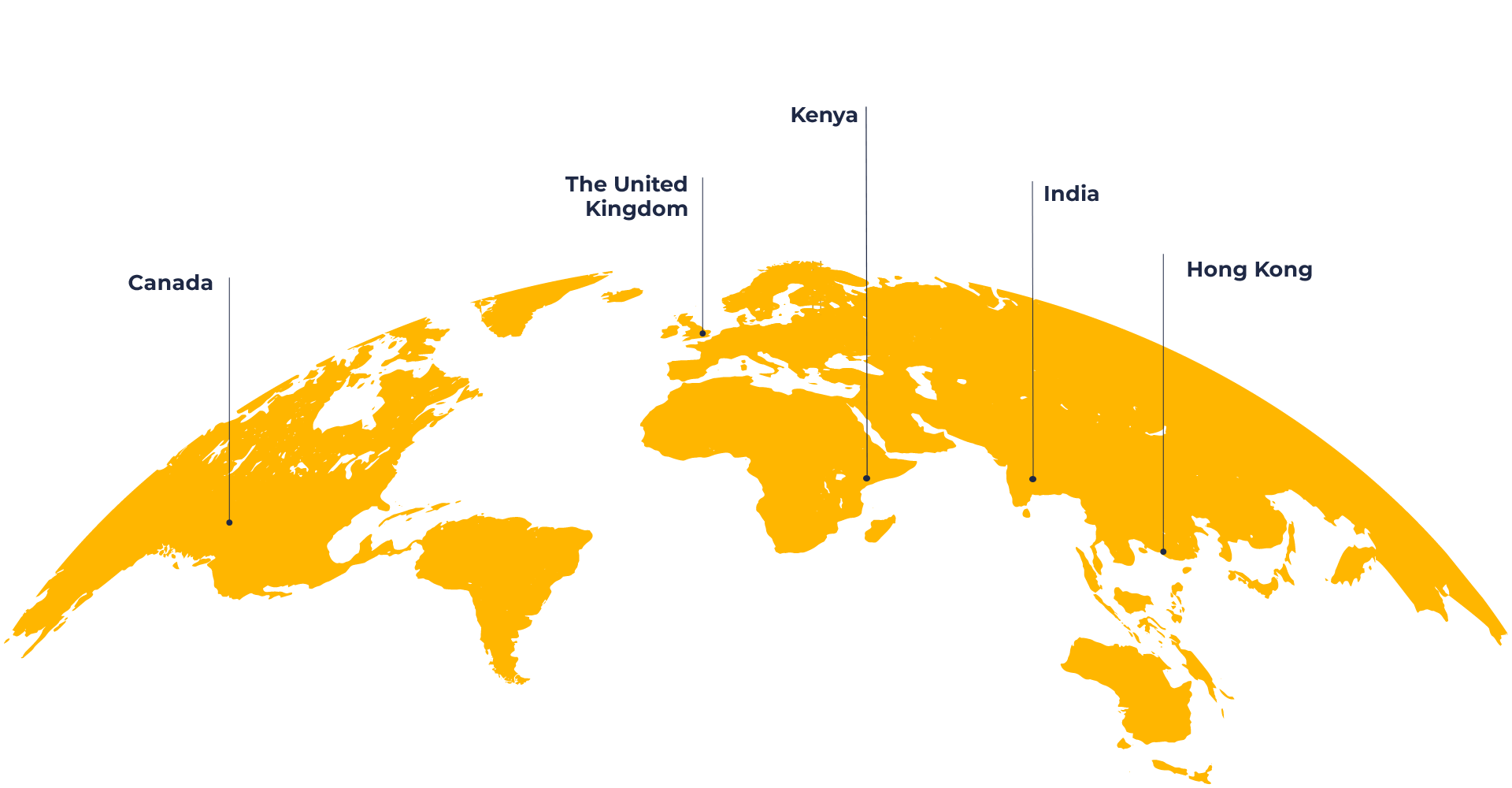

One third of the globe is affected by the de-risking trend in correspondent banking, which started in 2010. Reduced clearing options for trade finance and international payments are affecting especially smaller banks and their clients in developing economies. The Caribbean, Sub-Saharan Africa and Emerging Asia are the main areas affected. BFI has been formed in 2015 to ease this problem.

Our mission is to enhance financial institutions’ awareness of the different regional standards, increase transparency and enable standardisation of their risk assessment.

Our Services

BFI’s KYC Profile Advisory and tailored introduction services are helping to connect emerging market domiciled banks to international banking services across all major economies and currencies. With our global expertise and advanced standards in KYC BFI offers solutions to many of the challenges currently facing the correspondent banking industry.